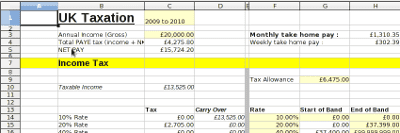

UK Tax Spreadsheets

Overview

Here you can download a macro-less spreadsheets for doing UK tax related calculations.

If you find this useful please consider making a donation towards my time and costs.

Downloads

' width='48' height='62' xlink:href='data:image/png%3bbase64%2ciVBORw0KGgoAAAANSUhEUgAAAEAAAABTCAYAAAAvKwHrAAAACXBIWXMAAAE7AAABOwEf329xAAAgAElEQVR42tWcB1QV19fFR01iusbeFWNiSyzRJPYWezQBFVEBFUGQIl2kSUdAmpRHL9J77x2k9967vTdiizr7uzO8R1GMJZL/%2bt5aZ82QyPP%2bzt7n3nPvmydF/YcvD72jVLKTBlXgq0%2bdd9UgoU5lu6pR2c4qVIaDIpVid5wKMxWnnE7soSzlfqcU966g/l%2b%2bbqVasdcA46NUoq0CVeqjRaGQQ2nKHf7Ey0RhlL%2bZwtQAE9lvg81k54SdkZkfZnZsfqCRxFwv3UPfO6vvm2Elzz/%2bxIE1X5G3GPo004SKOC1KWcvvoGR3/0L9f3595G147OdwayW5yLPKjhGW8jHRVvJFMVbHa2MsZeoizKRKgoyPZHrrigQ4qwkaEAcIEgfMIr/3CYkh/y8Ic4iN3U7up5KsZaiGAC3KWk10EoEUT%2bUohZ53UsguclWqKXZT6ixwVbqV76zQleuk8CTXSf5ZjqPcs/MOsk8z7aUfZdgdu5duK3U13UayJfXs0YoYs8OZ57QEvYwkN4sumj12TCt5X9UDa6jVC2dQQMv/HjraXIKyV9tFhZuKUel2ctTcSdM%2bCjESX5LjpKhY4KLknO%2bqVJLnqvyiyE0Jpe5KKCNR6qaIEjcFFLvKo8jlOApc5JDvLIt8J1nkOckg10EGORxpZNkdQ7K1BKJMDz4MMRTO99HZa2d5fLuwwNof5wCg9MU3/m/hk6ykqLDTYlShsyL7c6yF1JhEy2Pb021lPQpdlVFxTgVVXiqo8FRGuQebALrETZEudlVAoYs8AT9OwOUItCxyHWXYyCbg5%2b2P0Vl2UnQmE7aSYCKDRIzZIXhpC7YbS24xPbT1p4XkrxzurbXnf5uAqDPi1Bnl34eEmYpNSrWRdSxwUbxR7X2CgKvSTALKCTyrOgkuPM3AF74enigvBQaeQNPpNkeRelaCjWRrcTZizQ4%2b1hRdFyWwet5axgn/%2bSvGTJyNKNMjlMmx3z9Ls5HeXuGpmlPuqXKvW3VVcOHpMg8lmgsPnvIDwjv0g2cVZ%2bDTuuFpAk4nWx1BEokEi8MIMzrwyPTYlrgDGxfsRp0dxVH%2b47%2bBJ7VKJViIU1n2x6gpoz//KMtO9o8SN6XkKq8T4CrPwNNcePSFL3qd7Rl4DoG3fxU%2bhas8A55oJUYTeDre/BCSLA/D95TgE0OJ3/y/%2bOzT%2bWRow2ZOGj34CThve5SKOy1LFbodHZZoKbm%2byFUxhoHmBs2Fx8vw/6g851Xl%2b9qehbcUQwKBZuDjzhykY8xESTIOwkNd4NLOlXMNZk4aNb7SS37wE0BmaSrDTmxYrpP03FIPlcyKc6pEedWXbT%2bY8GDgmYg9Iwp/3b0wk9nSsnTO5HVkeB8PKnxJpCpV6K5I5dnKjS1wkg%2bu8FR5wFi/z4Q3IHzBO8CnvQE%2b1kyUTUCUqQgJYUScPgBfnT0P929e4Dhv5rgFotsWD14CUi0kKT/lvcPzOMd3lrkr36s8p/qPNc9TvqAPfM4b4FPeAB9NgsAj0oSFp6NJEkIM971QFFrRsGPlbKFBXRWy7WWpFEupxbkOx53JhEcz8JUEvt9yx21yitgEdMPnD6B874zPrPEEnmv9FC58kpUYSQCBt%2binfF/4nggyEKLNjm3%2bm6wI2mSYYwYtAaXuylS6rYxIrqP8BQL%2bopJpcpgE9Ex6in1m/LeF76M%2bs85z4RnlEwh8vDmB7677V%2bDDjPeT2EccIMSUAQ5vX%2bxFhvnL8I%2bGUp8MG/rhwB1kBNlAiSVFrK/BLHf1fmoERhY%2bOiKwVNgN%2bxP74aguAseTwnA6uY8M6ABR9ChJgixxgiyZB0iQNjeDwEYYi8JdXRA2SgKwkCehKAjbEwfgonUQ53TFcE7vMFw0hWGrIoizivxwVOVHqOE%2bMHbn1T0DH2rEwtPBBkLs/5cR%2bKV44pivjjJjPrht0YdLgLLAejZuphlRkSbiihGm4n/76B6kXbUPwUlLHK56MgiwUEGotRpCrE4g2EIJYRbyiDCXQZiJOAL1heGptQ/eJFn%2bBmIIMDoKPyMp%2bBodg6%2bxLPxNFcjvqSDGVg0JHHU2YmxU2PcIMpFGkPFRhJ4WI8neB59Te1jwbvh9IPB0kP5ekgAhnNi/8sa6xTMsyJA/G5QSSHHWoAxkd%2b8zOi5Uryst9OKs5jHEOBmgNtYZHWmeuJB%2bDhfSPNCa5IqqSDvEOerA00Aadqr7cVpOEBYqovA0lEO8ozaKA8xQH3kWrfH26EjkoDOJRCK5j7frjjgbtMdZoyXaElVBJkh2UIOP/hG4awnBX18IwQSYUZ6BD9QTJPd7oSu27vneDfMDyVAnDMoW%2bkZ%2bEJXscXpfboBVQ02s84vmJA%2b0p3qik8B3slcPdKS6oyPFDR3JrmhPdkF9jD3KQixREWqJ%2bihbtMRxCDQHbQScidY4O7TF2bLRGmuDlhiSlBgrNhj45igLNEeakziDxnAzZLmqw0v3IALI%2bh9EwBn4ABJB%2boIwltwIYv0kMtQfmfOHD54A/F1LFYXaSdXFu96/kOFNX8r0xsUML6J6N3wnge9MYcKNhCv52ZUkwgVtCY5oS3RER5IjUZpcEx3QnsAkwa47uPCtLLx1D3wLge8OczZaSdSHnEa%2buwaCjA7DjyQhQHcPaYb2kCTshqXcZkj%2buSSPDHU99yDlAyeArLHlERzVlmQPYncvmrF8t/rdyjPgfdXvSCKlkeTERjtJQDsBb0voVr%2bVB95Pecbyvcoz0Dz1myLM0BxuitZI5mqCLOcTCDAQhYcGP/x0dpNk7IKd0jbI7f6lnAx1zwedB2ZMHscGk4CKSI52R1q37S%2b8Ab6dC96WwFWcBx83ELzVG%2bGbCHhT2GlyPY3WCBPEWcnAXXM3mRgF2HA%2bsQNKQstryZDFSXz5wRKgKMbPBmOrqiiOCTvZpffWfLflmQT0V56F59q9/SXl%2b9V8dP%2bab4k05yagF55RnQFvDDMmSSARaoQKPx0k2hwjLvgDXtp/wlPzD6gLr2gk42R2RV9/sAToyIqyQfYaX1dG2lteTO%2bpebpH%2bZTueu%2brfHtif%2bXbXrJ960u276l3rvLNL8HzwJloDDUkPxsh21kJbhoCOKf1JxvqIitbyUBPkBjxwRJwZPd2NpgjqPJwW1PG%2bgPb3qXX9i/Bv2/N82zfyIVvZCLEEA0hBmghCSg5p056BOaojJ84YSfUhFcwCVAjMfIDTn9D2GDmgOIQ61Ptyd3gna/UvPOg1PxA8I3B%2bmgi19oAHeS4KMFbexecVbdDZd%2byZqZ3%2b6AO6LsK5PqdUWuIdWTA6f417zx4Nd/H9jx4JhqC9MhVDxU%2b6vDQFICd4lYo7V324eeAvgnI8DCWrQiz6WpnE9Bf%2bfet%2bea3rPlGBj6kF74hSBdNwbp0tZ8maZOFYKuwFfK7f64jQz1G4qsPn4B7BVSEjaZQtrdJDVH%2bBTPptb%2bk/GDWPAPfwIWvJ/D1gTpoDNKha0gCYszF4aC8A7ICSyrJUEVIfPHBE1AWakWdVZdYGW2v5U/An3cms/D0W9V89JtqvrvB6Qvf9FLN85SvD9RFA4FvCDzFRq2fJp3lcPwFR2UnxH9fwHSCO0l8%2bsET4KQnQ61fsXCit4nicWL9Z8xaT%2bDpN9b8S709r7XtX/Omb1XzjPI88PoAbXLVRo2fBp1kJd2le%2bS3G9uW8YWSoa4blFZ400p2jz3EVlNiXWWY5c2WOPt%2b7e371bwZATd965rnKc/A1wVo0U1B2qj2UX/hpLq3fe%2bGBefGjvxUmIyR%2bVB12KBsiYELlJbkrpkxHI3o%2bqizXczmhsDTxPb0u9c8F/4ta56Br%2b%2bFJ1ctNJIocVd5cnTn8rjx33zNwE/5aNjQL7787OPB%2bUQ5yEqZ2rF%2b6Qg1CX7h8mDz%2bp5dXTc8/dqajxxowjN9h5rvtX2dvxZd569JNwZqofKcGqJNJa5%2bP3WcDncbPDjK816z%2bSbxbsekupyKrAw1J3OAPa/m6cGp%2bX62BwPPRFvwKaSelflLRmBVxuSxI/gH9UC0XxlcTWbnAh3pPfvTXE9l99nP029T883vWfP1XPh6f000kftiN2U4qgrWTh0/UovYfs6gfzDCe61cMocqCDdhbsc5nzp6Ms/b4FJb7Fm0xbLwNIGnifL0h655HjwTtb7qZPNz4JLQb4tcyTjWDErn9zad4cZfFyyyVBaxqg01u99KVG/t295GDmD796t5Bp4Fb/DXQLW32osUa%2bku0S1LgriHH%2bMHvfYHeulLCzKXj4U2/brIXk3Eo8zP4EY7U/s91v/36zxXeTYaA8jV5yTSraXv7VqzIHLsyC%2bZjm/aoJz/vUl55mVj70jheRdz%2b7m1qa5eiItpZ56/GdqiSERzE8Cb7d%2b75rXQQMBbg7RQde4EAk8fxXEx/luz%2bKYyx99sYzJh1IT/Fj4/P5%2b6e%2b8uNfqLkR%2blpaXNraiulqxuqItMy0i%2bFRvojGQXHZT6MwcWJmiL5G5u3rHmGfgGssw1kagj9Z7FUYC3sSS01Y/g0ImjXVJ68nEyOvIqwuIiSxgHMOPaIyI0%2bPBXrl7pfh4oLvbL9PT0ZbX1decuXbmEx88e4/6TLqRmpdHmp3XoMLtTdImfERpIzdeHdIP3KM9Tv6/yQbzeXptb95qoIeAVXieR5agM65PikFYUoxUt1WmHFDecKwyAdTjn0UlzrcC1W9b9On/RD8zTEcO0OHqDmwAmzM3Nv6qprdG/fvNG/YOHD54/fPoQXU//woOnXWi51EonZSTRLs5OtLudGULsdJDhfJIA6qMl3AgtEcbEEUZoDjNkDzSY/XxTiG53BOuiOUQHzcHaqPRSQ4yFNKwIuJqCDExNjHA20J52Oe9F%2b5aFwrc8BF5lgbRjpsez0wEWbSJyh%2bWnT50x/YN/OiwoKMhCf/rpp%2by1uqb6p8tXLnve73rQ/tfjh3j49yMSD3Hv8X3ceXyPvvHwFmra6uHh5YWE%2bDhkpyUiMcwbYe5WCDFVRriOOKL1jyDBTBoZdgrE2oqkmZFF9GlxhGqLwENZCNaKwrAzUIGjhQHcHGzh5e0Dn/BA%2bOaGwK8yjEQo7V0eTJ8rD4RrkQ/sMlxhFmvTrGCtZrtp11b2wang0qgPp/rVa1fZa3Z29g%2bXrlx2u/fgPv5%2b8QxPnj/BX0//ogk8ffvRXfrGX7dw68kdtF5rh4%2b/D0pKS9HWcQGlldWITUxG4All%2bGzfAJ8Nv8Lr9zXw3bMRvkKb4C6wDrZbl8Ny9WJoLV8Mue1bYHbGEv6hEcg6n4uSsjJE5cYjsDQCflWh8C4PgmdpAFyLfWnnYm/asfgcOIUeMAw/c0vaVMFj2cply5nzS8cQ138PTyY59srhcEa1trVG3rl3h35GP8cjonxXNzxuP7oDBv5q13Vce3gDjVea4Rfqj5z8XFy8eAl37t3DtVu3UWtshtyfliHxmwkIHjUBHt%2bMh%2bPIcbD7ZhxsyL3diLEwnTYTBn/yIyk%2bAdV19WhpbkFlTRWCciPgXRzUA%2b9W4gvnIi84FHrCPt%2bdtslzoa1znaAbanL3wPGD3ouW/fQDMzmKSIn%2buwR0dXVRYeFhEysqK4KI8nefPv%2bbnfCYmucq3wN/%2bf5VXH5wBY3XmhGTEY/ktBTU1tTizt17uHHnDlq8fVG1gx9lYycjb9IMZJBInDQdMROnIZxE6NiJsJ/3IwwljiIrIxP1jU1oaGhCUXkpAkrDWPAB4MHAW%2bU40eY5HJxOs4ZGkMHd7ft3ms%2bcwsc%2bL8OJ5LzfZNfZ2UmFBAZPqq6uVr15%2b9adR38/Zm3f1Wv7fvAX7l1Gx92LaLrZiqLmUkTEROF8VjZu3r6N67duobOkFHUKyighaudP5kPWFD6kTJ6BOBIRk6cjaPxk2CxbAaNTp1BYVIym5lZU1dQgrTATPmUhcC/1ewnejYGHVY4jzLM5MM2ypU9nnoVe0hnIcpQvbxf7Q4PZHjP7lu9mzn47eFFRUcrHy5tSVVGltqzb9EltXZ0YWfpqnjx/ylOea/tu%2bGtdN3rg2%2b9cQMvtDjTdakX9zSYEhAUiNjYOV65exdVrJEnXb6DGjoPMmd8jg0AnM%2boT8HByDZo4Fc4zv8MZ/l2wc3ZGRVU1sT9JZHkJwrOjca6E1HyJz8vK94WHcaY1DDMsab20M9CIMYS4pUzxml3rJbkHpG9/PtDS2sI6oLCwcOO1G9fjHj55NGDNvwrfzqrfcLMZdTcbyczth9DIMLS1tePKlau4fu8%2bauISkCS4D4nTZyFmwlQWPnDSNHiTEjBevhJnVE8gOi4eNbV1aGpsRk5JHrwyie3JbO9U/Hp4RnnDdEsQePpUiim00k5DOVgLYpbShSPGjVnJHJJK2mu%2bWwncuHUzlqzzfWr%2bAf165bvh6280ofZ6A6qv1yMwMQSh0WGoIqsAMxlevnqNJKMNpeERCPthEYLHTWJt70USYDtnPrT3C8PB1RXllVWoIxNgXU0D0ouz4Jx9Dk6FA8Ob9YcHgac1U4xp9WRD%2bkSSPmT9TvwlqCGcPG/lj/Pf2CNcu3aNKq8opzIyM74uLS89eK/r3kVmnf/r6UO6F/72P8LXXGtA1dValF%2bpRkJJMsITI5GWmo72jg5cunQZF4gTGmtrkWR0Gl6r14HDNwtWC3%2bC5p8COGt2BglpaWTia0QtSUBZWQXiCpLgUODJxsDw1n3hoZlsjJNJBvSJRD1aJUkXxyM1IOYke3f28vkHCOKoMaPfsG94gRdUTl7Ot81tzdn3H95//PDZI57y9JuUZ%2bArCXwZgS%2b5VIGctkJEpEcjMDAIzWQ5u3DhIi5cvEh6gw6UlVcgSkkVnDXrYSSwC2YmJohJSEAlV32mBLILchGcHQFOkQfsXprw/gEeBB7K8TpQiNOi5WI1IBms/Hzl/g3ek/mmrvrHuUBLW5u1fk5%2bzm%2bXr19%2bdvfhPdwn7e3b2L7mWn03/OUqFBP4ggulKLpajrCsKDi5uaCGLIcdHZ2sE1rb29HaeQH1ljaI2ysMe8ljSIyLY61fX0/Kh/zZqqoaxJ1Pgns66fQK3N5kexDbvwwPuRh1yMSexNFwZZr/1P4Hy3av7vnU%2bKNhAxwflJaXU/EJScsqa6p97xPV7z15gLdTngffrXwhgc/rLEb%2b5RKEnI%2bAvYcjCgoLWRe0dXayzU1rTh4u7d6PznFTUfbzCoQ6OSOXLH31xP4MfEV5FUIyI2Gb5oKzr4NP7YVXfwVeA9LRapCMUoF4uCKE3SWxRmKjB8FcyvDL7pZ6dX/PzvwlRRJNbc23yc6OJr09U/P0W9m%2bB74M%2bQQ%2bu6MA2RcKEVYYDecQdyQmJ7HKtpIyaCbXNo4TLi9bi%2btfjkHTt/PgIyOHNKb7IwmoIE4oLi6DX3YILLMc3tX2rPIsfKQKJCKUaLEweRwMkcU2dYHaRcsXa3Bd0FsKFpbmvNuP65rrzS/duMza/ubD94UvRGZ7HjLacxFTkwTftCD4BfijqLCY7BYvo6m0HG2Hj%2bLCnIW4NHYKGqZ/j8D1mxDn7okisv6XVVQiMycbHtl%2bOJNj/17wUt3wIPD0wVBZiITLgP/MAayX2BxDOPn6nSJl5WRx9/gx6zuudMbcIWs91/b0u9qeUZ6BT2vNRnJLFpJaMxBZFgdbR3tkkPa2iSyHjbn5aPtlFTom8aF94gzUT/0WKfMWIdzIBCm5eSCliIi0GHAyPWCWbfdONf8SPBh44WBp7A%2bWxG73Q9ik/2cpQV3L9AWfjuA%2bR9Xc2f31s4raSuuOaxeu3yKNDld5mgff%2bs7wmUhsSkdiSzrCyqJhYm%2bG%2bJRk1JGeoDkgGO3f/4g2Uv/Nk2einkQFaY39ZeUREhOHorJSeCT6wirNAabnbd6p5geED5LE3gAJ7Ak8gq02gp0zVn5/auTk0ZMN7jh3J%2bDRiyfsOX9da0N85/WLuP7Xzd7e/hX4V23fD76tW3kGPq4xBbHNKQgui4SpmzlC4mNQGp%2bEZn1jtPLNQfP4aWiYMhO1BL6G3Hv/uRu%2bzm7ILS6EXZILTNLO9to%2b9Z1s/xK8OL3bX4wWCBTDVvu9XUuEV8RPWTT9BxZ%2b757uAw9y/aLlclv%2bxduXceXBNfQq3/HWNc/ApzDwzemIb0xFTEMSohoSEVQRCZsIB3hHhyDTyQ0NhyTQNGM2GiZMRy1JQBVJQMXE6fBesQZeekakDLJgkWrPgpPevsf2WsmnifKG7woPAg9%2b30P4w18UWziC9Cr5jS1Tf%2bZbw84D57y8qHFDRw8l19kEvuLyA1Z5msDTr7d95ett3wc%2boi4eYbVxCK6KwrkCfziF%2bSBSWw81m7ajftp3qCXb4UqyIywjCSgl94E//gQPeUUEpUbBNNMW%2bhkW0Es3x6lUAp/yPvASPfA7fUTwu88BbHbagzWntt2ZtHQaP/sQxfmCHCopNWVkTlGeROfti%2b0X718BF55%2bfc33t316K6N8Zo/te%2bFjEVJNOsGqCPhWhsI82AVeUlIon7cQNVO%2bZZUvIw4oJtdCkoDIWXPhJnYQNlFuMEq3hm7GmX%2bA13g3eK8D2OolhE2uu7HWYsej8UumHCYJGE3VtzVQ6dkZE/PLC8%2b03ey43nnv4htrPr8vPM/2TYzyKYgm8JFc%2bODqKARWRrDneD6VITAKsoeD6H7kT5jGTnqM8gx8AYlcsj1OJJOh%2b94/oRduBd1UonwaA2/8jspL9bN9D/w5Au%2bxh97gvgtrHHY%2bGbN4ojx7VtB2rYNKzU6bnleW79N8vfVu253O18/2F3nKF/aDT%2bIq3xeep7xfBXOGFwzP8kAYRdnj7CFBJI4YhxICXULUL5jSDX%2beRNroKfDYtQXqcWbQfi/bS72i/Hav/Tx4EHh6nQc/VrrseDr250m6zIfdVMPFZiolJ31WdllefMPVpq6W222vr/kLBL6zr/KZSGpm4FP/GZ45xir1g0WmK6yOC8Pv6zGs6oUM/JRueOZ4LGXUZHgIbYFGpjlZ6t4eXuQ18H2UZ%2bCx1u1PrHbfiWWO2/6etJbv7BBqyE9U/cVGKi0/Y3ZOeV5u3ZWGx403WwZW/sLLts9klefZvrfmo/rA8w4w/eBS5A1OpR/MdaVgPWo8MidNRx6rPB8Ln0YaorDZc2ArtxsaWWdA9vNvqHkFAi/3TvCrXHdghet2/OKw%2bRnf9rl%2bI8ePXkPVkQRkFGbNy60oqKy%2bVPd37Y1GFr78Si98fl/lW7m2b3615vvCe/GUZ8/wvOFY6AlOlR%2bMrZWh9%2bNcxE%2bejiyShAySgFSSgGQyL3is%2bxVGRmI4mX6awOv/g/LvB7/ceTt%2bddmKpZyNz74T%2bDFm4vdTNlFVrbVU0vnUOZnF2fkVF6ofV1%2bv64a/TOAv8ZQvHAD%2bLWxP4F248Mxhhl2pJ/Q9taEu8BuCp0xHCml%2b0kgCkkgPEE/2BLYHiP1dFaCaYjAAvGof278e/qWa7w/vtJVe6rQZi203POPbNid4zMSx66i8inzKP9R/WmRSlEdxe/ntimu1DDxdeLG0n%2b3TWnttz6v5iH%2bAd%2bfa3rHPMdbZAlcYRJpAQ00ErlOnI4ZAJ5MyiJ84DVFjJsNMWRDKUdpQTtDt3c%2b/A/xrbd8Nj6WOm7CY8xsWWKx5OnLeGFMyCS6gErOSKDW1EyPsXTkihe2l7WVXq4jtS2kCT79une8LH9zP9kF9lPfqB89saS1yHGBMNja6rmownTINQaMmkqVvOqJJKfhPnwmD02JQSDdk4Y%2b/Av8Otvdg4PkJ/M5eeAcC7/AbvcB6HeZrLX/61XffMIcjMykDUwOmIx4qKSM5KzonLj%2brIQeFl8t4ytM9S11zb5MTOSD8QLbvPcmxYLa05%2b1gnM%2bBXqge1BbOgfv4yYgdPxVh0/jAWf4TNG2lcDxd//2V9%2bQp/wo8TZSnFzqtxzyjFc/5ds2r%2bWLS14JsI8S87uMv5jLM0snKIOx8VOf5tnxkdeST2T6Hgad5Sx0PPvwta74ffJYdu6szyrOFTrQhpP9YBRs%2bPoSPmoTAmbNgJLwZyu5ykE3Sfif4npr3FHyd8gR%2bAxY4rMcPlqvw3fHFl0ZNHWv7yfDhC3ueJh3/3TTe0cA31r72FpGFcUhryaZTW3nKp9JceDr8HWq%2bH3zWWXZjo3/eClqxBpBU3gMTshr4fjUO3t9/h5Na%2byAXqAyZOPW3sv0f/ZR/BZ5mJzwevN06/GC/Gt8fX9I1Ze23zIHIJob1028%2bH%2bAJsPWrZ5801tRxjfJ8HFubjOT2TMQ2JtOs7Wti6ZB3qfnzvcqzuzqysdFJN4NGgiFkneSgvWwBOMNHwn3e91BykcaxmJOQivrX8OiBdyS2Z5S3WIVZogtujVs6xeujzz4R4H6x8rXPFQ2ZyTdzlpqxhpZNkEPRuXS/v5n9fGRDAsLqYhFYHUkTeJrUPD1gzef2r/l%2b8Nz29iTp8JRiTkFx08/QHzkGVqsXQy5AEUfjTr7R9v8I70KUdya2d96Mn5w3YqH5Wsw78cuTGQfmlY5fNMVm%2bPBPtzGP9g39ZNhHUzbOeuNDUJ8dEBc5pmOrH8WJcW7xOO/X5VUQCO/SYPhUhIB5OMGj1B%2buxT59laf7wWe9Cs%2b2t0n6UEkzhOTetZCfOxPaQutwLEgR4jGqbwHP1jxN4GkW3p0fq93%2bIB3e72Dh7TZhkTmxvOGqB3Pll17k%2b3120tcjv1YlPMyzRCO%2b3fnDW35LaCh7aDqcxMTZP8zZKXFCKsbQ0/QGJ8X1hXuRL%2b3GPJxQ5EU7FHjSDLxtniuYz%2bctct4An6hHKyeQJifxFA7J78Rh/hWQU/kTEsHyEItUZODpd1CeXuWyk%2bbV/BLbjfRC/TXP50r8fHPKUr7oL0Z8qcRUNYnJzPcHuExv/3rS7QTmt0as3rRm4WbBbb9v3rv1%2bB%2bHBRyPaEhVyJur3Nf00INxjCXOEnjrAieYk2XOJMcWRuetYZBpQfb0ZGeXRpqfFCNWeQJPs%2bt8nCZEzhyE0Km9OGx/BGIhx3Eo7DhEQqTp/cEEPn7t0%2boAAAI3SURBVIjABx6BgP9h/OEnih2%2bwtjmuw%2bbfffiN%2b89WOvCjxVmRPET6/Cj2K/3Zu38oWbC8mmBI%2baP0f9m7rijX43%2beg0Z%2bAzuN0f%2b3UOUkirHeGXBLBsTPqY%2b%2bmXFhlWHtwvv1N0ju48jrCkWIGEinSJnq9ys5KbepeqjDVW/U1AJ0IZKkBaUQ7WhGKEFxWhyjdOGfALp8hI0cCSA2N1HFodDGPXlIRomi/2BUhD0JuDuB7HTSRjb7YSw2WoXNprzY50R6eq0Nt9forCmea7YksxZgj9Gztw613PqLzPNxk4bLzeUoraQ8c1l6pz7jZEP/8g837TpvFtmFv2GBPMffiLBv2z9Mj0BqT2BIppi6aK64nmihuKloqfFq0TNJepEzh5tErWXaj3ofKz9kLt050F36SuiHsduCntI3drnJnFjt9OhK3/aCl/YbrG3fbOxQNtvOjub16pvb1ipvKlmudyGimXS6wuWiq5Kn79lccDkWdOMyN%2b3n8QG7sOSM7hjGf75hK/%2b0395bgjXXp9wrTaKW2/fkWAaDeZhpd%2b43%2bFhOi%2bRoUOGSnz51ZcKfLNnGCxctZizeP0S5zk/zzs7YeoUg8%2b/%2bEJpyJAhzAMNYiSEuc8B7%2bC%2bx6/c7wMw0/ckLvDn3CfEh1L/y39yb%2bTIEQMl5WPuN7i/5H4UNYprzYnMUdTnw4bPnDBxwuzJ06bMGT1q9PcfUR9/y33udxL34edx3FZ1BPc9PuW%2b5zAe8FffjvrXY/8/omVbPUbzdOEAAAAASUVORK5CYII=' /%3e%3c/svg%3e) Employees (PAYE)

Employees (PAYE)

Personal Allowance, Income Tax, Class 1 National insurance and Student Loan Repayments.

Tax year 2017/2018 (From 6th April 2017 to 5th April 2018)

Tax year 2016/2017 (From 6th April 2016 to 5th April 2017)

Tax year 2015/2016 (From 6th April 2015 to 5th April 2016)

Tax year 2014/2015 (From 6th April 2014 to 5th April 2015)

Tax year 2013/2014 (From 6th April 2013 to 5th April 2014)

Tax year 2012/2013 (From 6th April 2012 to 5th April 2013)

' width='36' height='62' xlink:href='data:image/png%3bbase64%2ciVBORw0KGgoAAAANSUhEUgAAAEAAAABuCAYAAACXzxWYAAAACXBIWXMAABfWAAAX1gFCcJy6AAAgAElEQVR42t1dB1hUV9O%2bCArG3ns3lmAUjS3W2DVqLLHElsTYEkss0Rh7STT2GsXeUFQEBbHFXmPsRkFULNhRFJDe9s4/7znn7i5VYvu%2b7%2bd5xpXdW868Z87MO3NmL5r2fn9KsXRmWcRyjOU%2by3P1eky931kd9//ix4bFjiUDSw6Wmiz9WVaxnLaxsXnIEoxX/K7e76%2bOy6HOs1PX%2bZ/8ycvSiGUYyzIWb5YzLLdYntna2oZnypQpCq/4Xb1/Rh23TJ3XSF3nf%2bIHs5WNpRBLRWXO81jOssQ4ODhQzpw5qUCBAlSxYkVq0KCB3rRp0wS84ne8j89xHI5X581T16morptN3ee/8qcISyeW2SwHWfxYHrG8tLOzi6tZsyb179%2bfFi9eTHv37qXLly/r169f1/GK3/E%2bPsdxOB7nqfP91PVmq%2bsX%2bW9RODOv38L86sTSmmU4yyYW3wwZMlCuXLmofPnyVLduXerRo0fCrJkzTXv37KF7AQFEJhNZ/%2bj8ewC/v4c/n8nH4Xich/NxHVwP11XXH67u56Tun/k/oXxGlkosAwylWcJYomC%2bbM7xbdu2Nc2bN49OnTpFQUFBenhYmB4dHUWm%2bHjWWKfECOiUwO9HRUVRGB%2bH43Eezsd1cD21LKLUfQwwBqhxZHwfSsMrA/GG6sYLWA4gjNnb21Px4sWpXr161KtXL5oyZYpp2zY30zWfq5QQE51I1SiWoASiB7FE92J0ehJHFCHx0JWInzg%2bz5fP3%2bbmZsL1cF1cH/fB/VT4PKDGMUCNq7Aa51v/sWUpwdKFZQvLHZYEFqxXqlSpEn333Xfk6upKN27coLi4uEQTbGK1IljpJ6z0NcbjZDjR7lCiXSFEh18S%2bTEqL9gw4pMYhhkMvh6ui%2bvjPrgf7ov7q3HcUePqosZp%2b7YUz8rrrA6/DmZxZjnK8pDXZEK5cuWoQ4cONHnyZHJxcaGTJ0/ojx8%2b0CneovwLFr8Y0qHwrhCdtr7QacNznZY/I1oUKMX5KdGGIKLtwTodeKnTWTaHmwzS84QkC4Wv%2b%2bjBA/3kiRM67of74v4YB8aDcanxYZyD1biz/ittW7dubZg6HEsxlsYss1gu8k3iOG5TlixZqEqVKjRw4EDy8vLSg1%2b8SDxbJGc7gM37L1Z8K3%2b8gBWd/IhozAOicQ%2bJxrNMUIL/j30gX6c9loB4smX8zefeZSCC2Syi2WcmJLEK3Bf3xzgwHowL48M4MV417sZKD%2biTQemXhmfLKHxJGcXIViqGdo8lIl%2b%2bfNSsWTOaNm0aeXt709WrVzEI3XqeHvIoT0cQuQcTrXqm02JWZtYToqmPpLLWyk9UYoAAmaRAmMPn4NyVbCmubDF7ebn4MhgvkzhO3B/jwHgwLowP48R41bhPKz2gTxmlX6pevSBLbZahLHtZgkBK8ubNS5UrV6aePXuSs7Oz7u/vn8gyYzAbrLh/tDThVUFSYcy2MbMTlXKwgtRkkjrGAATn//JA/j73iQT1DC%2bP%2b7E6hbFFxCexCIwL48M4MV6MW5GqIKXPUKVfwZSixocsfVn%2bZHmCUMPmlIALjRw5knbt2iWcUGhoqB4bG2sGIJL/d4MR2Mkmu/SpTrOf6PSbUmiileKT/gUAhlifP4U/n86WMT9Qp7VBOh0Kk1HE2tViXBgfxonxYtwYP/RQofOJ0q%2bv0lf8wGM6KnT2sIRjLTk5OVG3bt1ASti5ndQRm61DFNZjME/BZUZgezAGptaylSm/SuH0imEVY5X/gHXBT%2bzhZXEtiq2BB2NKwiowXowb44ce0Ad6QT%2bl51Clt2BVE1guqJBiqlWrVsLy5ct1X19fiomJUUTNpOPH7IDipZNax7NhzHZKs/i2AEh6zYnKKuAfrkSyb0iwdg26GC/%2bi/FDD%2bgDvaCf0vOC0ls7rNnYnLS1sQkpUawo9evThzZt3Gjy97%2bpx8fHpxCRpSFcZ4e0mtf6r48s6/xtKv0qMMYpH4Fl4fIc/keNTU9OJKCH/82b%2bkbWqw9ziGJFixLn1yEcJk9qgl7a2MRktLePbdi4cdzfZ86YrDQ1EE10wQT%2b9TyjPuOJNPl3MevptQYAMZPHcSFSjitxkNCTzhydYf0as57MJGMZAFBrNgcbG9Jy5NGrtf0y/qzPdb4URacFAH7uswPaFSrX/ugHcjYmvicAJqrZx31xf4wD40lmq8kBiPa5cTOybdfu8TkKFNRtZIKlAMhbhIq17WZadPxS%2bM0EigiNF6s%2b1SUQxXZyl92Dd4iM81gKU6wG%2bC58gHVEwP1wX9wf44gyUao/AIIXs4ndRMTxa/7hbXv3N%2bUtWYYSA5CvCGVq1lkvtepgQq8rIQlej8P0Z9HxqaAquU8M3/QRI3%2bGneEmXoezHlvi94R3EAXGKF%2bD%2b%2bB%2buC/uj3HoeuoARLM/fBxP%2bhVeJasu%2bSc0%2b6afnq9EqUQA6AyArjX%2bkrS5u6jA/vvU%2b9wjWn77hf5XUCTdj4yjiPiUIYaVhDBOlyIlF1gTJM0SzmmSFcObkA7LsJ7ppOxQcgB5fdwH98N9TakojqQqkoccxMfc5lzkHB%2b/n01g7jl/avx1P8pXvCSWgJ4YgCadSFu4h2y871Jmj2tUzPuG3ujIXZrlF0QXQ6IoLoW7wSLwNhxQWIL0xoeYr654Jint2BTYYHoAMPIDCK6D6%2bG6uD7ug/uZUnb64n2A48fHHgkTy0T3YNC8mTUtPO9PTVIAQCwBrQlbwMLdpO28S5qbH2nb/Cir502qc/guDb74mJbdekHHnkXQ46g4svIPurV/iOK7M0PTz0eQfuAlCZK04bkkLrNVTjDOypzHW9Feg%2bTgOJEhPpfn4zq4Hq6bfK3LgeBf3PtZnE63OAm7yATtMC8RT5ZtLG4sO%2bMBwE0DgOQ%2bQFjAoj2keQMAXxYfKVuukt02Hyq5%2bwZ1O32f3O%2bHUkBELM9CGgsPWSF/HMqzdYNn4igrsZmzwkVPpQOzjhjGrON9fI7jcDzOw/lxad9GKB9hkpEAiRjqDNsYuC18HbdgJcoCFlksIBUA/viTtM3/kDbNlbRfN5K2YBdpGy6Q5nWXMnjdoiK7/anR0bs08PwjWur/go5Ki9Ctqjl6ssExUoF881sxoM5EJ8Kl9974HExSvuJ3vI/PcRyOx3kpYGy%2bD1uDjhn35xk/z0nSURRZWLwYOC8GbsOTGFpw9jr9uu8UTdv/N21%2bFk9/XL6bBgBNO5PmfIi01SdJ6zOOtK5DSOs7QYKx7m/SNjIQmy6T5nqFHNhHVD9wm4by0nC7H6r7vYzRX8Yl6Ows9ZgEM23WU5qvOP7scRzpF9msQafxit9Zl1TOEexW53Wvs3MT579kcDgr1C8yYAd4nXvwrLvyjG9iJTey4uvuvRRK952zlLqO/ZX6zF5Cq289J2efB9T0m/5pALDsMGkrj5PW7UfSnOqRVrQMaR/XJq3tt6SNWkTakgOkud8gbdc9yup1k4rtuknV9t/SWx0P0AddfKSvuP2CzgVHJfD4YihxsmZlE7oey7PH/F2Hs8IrflfrWU9xNekUw/lHwu1oCdjxMF3f/1LXd/FS8UK1iWfcnc1/ydX7NGqjJ7UdPJI%2bbtiEilZwJKemrajb%2bGm08uZTWub7kAEY8CoAjpHW%2bQfSipczam6k5c5PWv02pPWbKC0Cx607w1ZxSYdFwE/k9/IjBoIm%2bDwFj4i%2bGBIddzs8Vg%2bOTYhnw4il5EWd1FYObIiTWz0%2bXIIU9ziWWVwkJRzn2fbi5bIlWM74xmfx%2brr7YazYI5p24G/qN28Z1e/Sk3IXKmIee3HHj6nz6Em08kYgLbv2iJp%2bmx4AugwirYyjBQCIrZ0EokI10jr2J%2b03BmLNX7pwlNt8yZYdZdbt1yivp5/OIdRU//BdnaOH7v4gNCQwKo6jOEWlE4CoKHYbD%2bIohE1cPxxGOvsIkyeHM0QFOLhtIdKxrbkTrP%2b2/zR1/GkcVahdTyhumzFjonGXqVqDuoyZwgA8/ZcAlPpIXgSfQem8hUjLZM9A2JJWvir7B7aGBd6s/DVeFn6wAl3bfEVahKsP2fJ75fb661%2beuhc21efpiw0BIbFHnkbE34mIDY1OMIWgniJB0SN5yYSw0wt9GkfxATEU6xOtvzgVroftfUm6O9Y3H%2b0ajAih61tY3Nn0t/H7C85cp75znal8rbpka2dHmRwyU96iJRiM%2bkJJjL9UlWqvCUCxshKAZl1IG%2bPMy2IgaY41LJbQvCtpk9ZK5bezX9jKAECURUAyuPnoEAd3Xx1LpN7hO5Ez/IJuXA6J9mMzZ4pDT%2bETQ%2bJ1P78ousGzHQkTdw8m3S1YZyEdsw1lEc62svKQ7bzuAcKknUeoeZ8fzDPvWPczNvfJNGbrHmrW%2b3sx/mIVK70mAHCA%2bLx9X%2bYHe0mb6iJN3%2bED0j7IRlqj9qSNX2kBwFDc5ZyuLd2va%2btO65rnbdI8/BkcX%2bEnsnj4xjrtv/W046l7gSMuPw7Z8ij85dUoCmGqGshO7alHsB6L9b2VFfZgh%2bfJnmNdQKi%2b9EqA7vIwUoABILZHSADG7zhAjXr0pg9y5CSHrFnFUpi69yQtunCL2g/7RYy/aIWP3hCAL76T4RGhcMQ8pM4SgKbMGyautgLAV746HyRt6CzSJrN1bLogLWPLFWkdW33wO7//D/iGqeO5QJMH1jcrvDVYCcz8uUnM9KYn0TTZ%2bygNXbVZhDDMPNa%2bYQETvQ6xQv0FADnyF6AR67aJEOjM3v6LH3%2bWAJR/bQBKSwC%2b/B7Ojgd9kbSRC0nLmZcByJocAPgCsMjfmEBV/pS0SrVI68Tnjl6iM4A6H6cjfGoefKyrBOGLM4HkHiJDmQd7hF3M6NzZ6TlffaCP3uytdxo1gSo1aEyVP2tGv/35F3nHy%2bWQDIDsOShn/oI00mUHbQqMoTV3g%2bnLkRMUABVfAwCsdwOA5l%2bRNstDfvbjLGkBWVKwALzueUDaL0vZWTooB8qOs2E70gZOk9dYfVIXS2TjJV4SV6jzhWe0HTP6wkQuDyN0Jiv6rOOXaeCStdSw2zeUr1gJcR04t1%2b27qY9JBVPCkAWWEC%2b/PTjSlehJK7RvM9AswV0/mVyOsPg8iOkrTgq13oRBUDJCuwH%2bpE2bgVp/SeTli0XaVmzy%2bNTAmDscgYoO5mvDZ%2bRvyhpVeqQ1qGfzuewRRwRAHS9EkrbeUY3%2bD%2bjiZ6H9A4jxupVGjWn/JyvO2TJagySsuTMRWO37aM9esoAZM2Vm7LlyUv956%2bgce77qP3wMVTyYydxbhG2APiGFX5PaPkrARBr/TQryiGuWgPSMmdhYXMvVk5GA8ymvYO0gpQA2H1fAgWQcG2EzYz28hVWUbiUPG8Y%2b5LVp6jzxefkci%2bUxm7cIRQp/GEFypT5AzHjGR0cxCuuA%2bXGuf9Ju1MBAOvfns%2bD1cD7F/voY8rMyyJztuxUrfnn1J8JEjvTV1BhIxnCWp6znbSeP8l4nzmLhQjZKZIBTpAaALCArDnlccU/lEBWb0RarnwWglKzGS%2bJ7dTh%2bF1a8NdVatixq/mzXAULUfVWX/DAW1NxVgTvZc2VR1hAagDkVUvFLlMm5gNyjFAe/KDnlFk05%2bQV4TvSToYAwGIOd5z1aevZ48/YStqAKaS16sEOraZ0foYCOXKT1rgjA7AqBQCWMQA5%2bLp8g4rVJZBDZ5NWtxVbhgKmHAM7fQu1O3qLZh89T5XrNjDPdN0vu7HX3yIGXrFOAx6orTDxsdv2WgBQYXCi50Fq3KuPWP/G2OAM4Thb9R9CAxaupBmHz9N6jgzIEhdzeEx/PQCWgNgOnzCezbpFN0tozJU/DQtYJn0ErlulLpOlNbzeOewN/p0TrLry/IpMqGZso/bHbtPc45eo2mdNxPtOTVrS4OUutCUoQZCcKo1biIFmzckAuO1N1QJyFSqsHJ4jteg7iMZ7/Ekrrj8RnEGQqPTVA1RFaFeAVMjzlrQGkBukyNM3kzZomswMAUbXwaT9yuTInYHyuJ4YADhB3KBqfZk87fCXHOKThhYAfk8OwCct23Asd6cdTJCnMcev2uxzysDUWzhBKwA8wuTrr0x6uo6dKpRGBjhoyTqafuCMSH1Bmrw4J/WMlhaDjDF9FaGdd%2bSMQQx258HKed2WJAbHYOZ/mk/aXE/5ufu15ADg2kilJ/Aycb1M2pAZEpA0AIDCQ5ZvJFdOCibsOMgpbVNLFLACwMgF5v7lQz%2bt90AEEbOLBgwoDYAM1ghrguyMTU9FaPE%2bqRB8AfiA%2b3WpOAQWASVBiECMsDTWn7GUzowwiLzBcJwIoUPnSAv6cSZpNRrL%2byUBoCrn7jb8fo3W7enHFZvEDA5dvcUcyuDQxrjtMfMAo9S1nlNhmDpnhbTpSYz4DDMOECBMqkT8X3zxlgBs8aXbaQHQWRY8Np6XSoD1TV5H2nxvqQBKZTB1LI8dN9W6vyatAoL/wwIw43kKSgCys7Ns0Z3X/wzJLT6qId//qKbFB5y4RJ80aibe/6jeZyJmD17mQi36DabseWXkyFOkGFvEAbMFYKYhhkPcESlfMfMofQHA%2bWf8aPKuY8wOt3NytJs2PoqiJf8EUJNXVoRWnWDPPYLDV0M5g9gvGD5XWgR8gqe/hfq6%2bVgAEFQ4QK550GC7TFLZjPyauwBpBYpKQMTSqGMFwGWq2ayVeB8KFyhZWmR3Ge0dVGizF14dPsGgwgYAhpOD8p5Rsh6IGR%2b%2bZitHh77Cgqq1aMMRZSatYrL16oqQNRM00mF4/Jq8FrsPY17/B2mzPSRIhtJmAHylZSw9IGuJcKoVP5Eh07qwkgyAS1STyUrSYxDaKn7agJqwIqjtLb1yT8w01rYBgAHGKv8gmn3iH%2bL8gbpPmkE123RkPlFYpcOO1HHkOLFUlv%2brZKhsJcuAENPtM0uLaNtbOjpwhW1W5XNrwXJZdkiGzzZf83nlpSUY16tcN5EF1GphAQAzX7JSFWozcDiHs/1i1mDW5hK3lQAMxHhwhLZDRokZt//gAzOFhpStVvM1s8HSqiIE2gtrAKVlUiJyBJCg4XMUc/RN4gv8ZCRB5FhzirPDTaR9z4SqzTcyKiBCfMLOcLobfXHoOs05dpHqfdFReHp4/TaDfqLvF64S2d%2ba2y/Eut4ZJx2a9dqXzO6ONPeefahIuYocMu0EgCiCgB5j/KWdPnlNAEqUlwAgdHX6QQ4eDE8si3zSxCesSlwQsfYJRgjFsgCxQp4xjEGrySGvZU9BhdseuCaocIfBI9hsO9Aw9vzg6yAuhrmrSpB5zYuCiCJCE5gJYomAPkvKnFuA2OnniSKk4r0SbE1vVhJD6WvKBtJ%2bXkxa617SEpAgfZakImTtC5Dzw1kifMIaAAJ4BXzMVL7WtC3sR05Sh5MB5MK5%2b3y2gql7Tog1ipgN5RG3BZFh5%2bYRnnjtW1eEPuvRmxOf7GLmW/8wjH529aIpu49T8%2b9%2beNOSmEqHO/STewWI/9gbSK0gIrjANVk5mrND7iqt5cxy82W1THDcTQmKuwSs07lA2sGmvBdxO1Zx/DBp3puZDK29G0ILzt4QyQwqPQYHSK0gMmqTJ6GKtPLmM%2bowYsxbqgh16C8B2HCW6ez81Eti5orQJrls6nBoG8LkZ%2bl%2baQ07FZkS1iL3HDufeyoA8I5QoSxazjxmfSnH7CFMiupwpghzRvkbfD7FilCOHOaS2IYH4WITpMOIsW8AgHVFqCUTmXlekv2ZS2KvqAihCIL8v3Zz0r4exb5ipbzGag6fbvAP1yQA55/RDlZkN5u8G5v2ag5n80770oTtB%2bjrX%2bdQ7XadRX3AIWs2WRFKJRmylMS2C1aIa7RkImWuCI2e/C82RlYck07P8AFwWuD9iO/wA2kBkLQgAn8Br49dJqTVWEJr/xJb71gCnS8ECQD28MzD3LGt1ar/j1TcsbKIChllp%2bcrCyICgAIFef3vFHwB%2bUHN1h3MPKDT6Em0In0AHJKh69tfSPuwsmVbrFZTuSyQBWJ2wehSLIkBgOWWvN9aCpaQhArXGbNMWBQsYOP9l/Sr5wFhpiAwBct8mOzcbLklAKlZQPa8%2bUUJDVlhl1%2bmUK22X5q3xz6sXpu%2b/X2hsAzJBNOiwphllLIxU/Vay/KXcQxCoBEG06oIWQOQp4A8NkdeWVEylPqU/cOC3dTpbCAt5USlcdee8h78GTY4cuQrQHmLFKc8hYtaAZBGRahocRkGc%2bYWodBGXQtlsnqdugvLgnOEdaRdEkM2CGUABFhcD84JPm0ha3lW7EoWRDqlURBRQJX9WEYRbLfDMRpZomNtWRI7dY/mMw%2bo3qS5yvqyCYfXZ9YfwomBxRnxPVFFyAzAYaGQURCBZGCyVrhsefq0fRfqMXmmYJNQHOe8IhuUPULmgggyP5fzMta3%2b05SYyiAEwsWS7sihHUP%2bowtdsT9rVd4WY0mrVRFSzb4u5s5Hf6kkcz7S1Wuyua6gLY%2bN4kdHqcmrURJLGk9wAyAp7SAgqXKisJJ5qzZqWzVGtTux5%2bF4i4PIwWT3B6e3oIIAEBGB%2bUhYHBwWkiJJ64hrfcYuY4r15HHQ9n0AAAegGoSskRzQcQtWUGkUsMmNGjpekF6pu45Kfb2UwRAESFYBRSq3Ki58B%2b9ea1P9DxM8//2E04VjBIAQLzjEzVJvaImuE3VBAGCURrD6/KjsrLTfThp34yWqa84zi8FAGwkUFPWy2NAg6s1SLMihNR1GHN7xPopu44LxbCeUyqJ4Rj0BHwzbT51nziDhizbSMv9nsi0WJXCBIMMlSwyfT1CRknMSGrA2kBj8X8oAVYHdgdiJMjRucQVoaQlMcw4NlUBHmqCrwSgtSAzGDyWQKX6ja02RiwAGDmBID0c3kByMOPIGqEwjgGdNqpCoM87090kteWKLIlj6xusDpud4PEwc4PbC2D8pdLWWaBREkOoxLVRBAGpQthDETXVilBTc0UIRU6Uv0BeUBzB%2bwhx2PI2SmLWWaGhqJE7YL0jn3C%2bep8zytM0yfsIzTh8jrawX3l1k5RBhNAgVZfDYL02cl8PmRyAsa4EWWd%2bBgAGEcqeyxIxUB4Dp0BvgUGuEAWsAKjepIUkLRUcxR7/h5/UModAo1I0zuPPZCUx6wzRqAwZymN/sV7nHlT3y%2b6iUWrF9cB0VoQg6Ako5yRjOKo6oMOo8qBGiPrgNrUV7uGXOAuEqWMZAUCU1BA%2bDS4BqzD%2bn7QkpipCKGZgto0Yjq0y%2bAVYxaIL/mJpWGeFwsNHyPdAo1EDRPUINLjip/UFPyhXs47YK0Sm%2be8qQmWSVIQwe804Nf7FWVqE66UUqkG%2bMuSt58RpwmpZBEFhBZRYkRNZEaqXpCLU2vwZBgYKjEIGiiPI%2bVH9RWh0C0leFXINjBU1BOQKYl%2bwQqVEFaHX7xEyKkJik9NB9gaB4MCcP%2b8p84KlB5NXhIwIgvCJLXEch%2b0xJEZ5C1ltjW2l9kdv05xjF6hKPekcscdXu10nUcT8eZOX2OZeezfY7MnNa1/9vpRNHcd9/v1QsWxAmESvUObM5rG/fkXIIC0w4yr1JJcHCIIKF5QMD7tFxs6QdSUI7yF6GOkvls3wefIehUpI/zJ7BwNwixac9qGm3b6mQmXLCVY3fO02Wn0ryJwew8kZnt9s%2booITT94RuT9eYsUkzSalUcuUaVJS7F83k6TFN4HG/zhN7k9Dk6PbA%2bNE5PXJq8IGeETYhAkRBGk0/N2yigxkc9bdlQAsOZmIM3Yd0LU7uf9fU0kLXBkBuPzUsUSa%2bdnMEG0z6ARAtkicoiGX31NP/yxlsZzOg2G%2bGYVIaNBAmFs9Sm5adJnvEx00CHSOIWaIGYe1WLk/kv2q80UPxkyET5RGAEY688JDtHh5D3awknKtqcxQmmQGIQzzLqxyYHNjHl/%2bYrqr3to8ppg46/7ig6RbLnzUJ/Zf4jjV99%2bIcKo0SDxZk1S7fpYeohFi0zuVCpCvpIxYt8AUQNMcdkR6RihOJYJjoGVuIomKVES8wiW3xUWdf4Qyd4ABBweBvzN9Pns1YeIuj%2bsIVlF6BvVJKVaZERPMIe7dkNHv6WSWHtVE9yImuDi1GuCmH0kUgiVaLJEJogNFmyLg1BhMwXOUewxyrIY6gGerMjeWLneoRx2cFASH7xsg9gmQ0aIdQxzFz3BoakXRFAT3IiaICuL0PeGACgLgMdHgRMKDJubek0wJSKEm6BLBP4Cax/XxrLY4iObpM4/FU1S3uHS3EFrwQJR0UV3SAbldLPnSUyEUmyTy1dA5BEAEB2knw8YqvoEHf8FANZbY/D%2bRiUHNBnrH54fsw8nmFqT1DirJilzRwmD9lF10lp8JRuup24SXKHLxee05XEUzT18lvrNdRYVnY/qNhTKWJ%2bPXAAFkdS6xOAEYQWoIaA1HnS3YGlZWUI06PjT%2bPRujVmVxJDJGZwe21pQAK0yiALYGElvkxQanTLZy9/Rv4Ol8dUw4R9QE1zDs/7d1FnC1O3UcWiOAiM04vmraoLYB0RvUKX6jQSAxsYqroGM8tvpC8QuU9olMZEM7ZPOasmfckcYmyJFlCXgkRVGWQv8Ps0WGVURQsc56ogdB8j/A0hco3ZL0uZ4UcdT92jRmWvUqHN3oUBGBqCMU3UxY7CGMlWrv7oixADkMfOAjGSn9iCLlKsgltLwNW605NJd4Vz/uHQnHS0yUAKOCmses4nlgG2xAsXkBqlRE0y6NZY0HcZsI/1FGjx7u/QlBhOsUF0xwVtib7BqQ5n2gruD1cHjj2BChE4xdH6lVhESW2McBo2aoH2WLFSgVBn6%2bLOmwoGO275f7BwjquDc9H9pCh4d8RqbIajlz90hiVCDL9jB5ZGKYGsMAKVVEUKTFEByOSc7zhxrplkRcmQTRmcXSlloiJBNUqlXhOAYsTUGALJzGGwgiNAamnvqqkiOUC8QpCpUVoTSWRBRXWIAAVtZCG1i3/%2bgDINfMC9o2UPye2sqnGJJrL4MgThfNEl99oTZXEQAAAlGSURBVIomqbY0Yr27IEIIhamVxESTFCuFhii007XsP0Q0RyMMIj/A%2bQiZAijVJbYz3RWhpF%2bbE3JV1gOQAWI2UTWe4SYJkpuvZe8vpZogSmK4BnqEqtZLu0mKFQaZAdvDBifa5lICwGh9QxY448gFUfV1eRAhmqtQ%2bHCzqhP8u6/NWQNgJDbGq0FpwfHxO0pjLueSN0lha8zI%2bxFKe42UVtB7rKwRpNEniNy/98xFYvZ7TZ1tTmhQG7BuljYUw1IRxc9gmTOIxCnMkjiZX18LAOuqT0pdIMYxSZukkDgZbbEIa7CCdn0lPTaqwqk0SaEXCObcbtgvwvyNXmHs/49nh5a0ImTMrvVsJ60Uvb4FJAUA6xhcf4fB65M2SflK60DvIJhf4ZLy2ogcaJLCPYwdo1SapJDQYHC5Cxcl%2bw%2byiEFikwMZH3oCjVzArGSIpYni3QEgqsH/yG3uRbslUXK9bCl8WB8LYJA0wQ%2b0Z2dZ3klag3V/kNEjZOUDkjZJZbS3F%2bSmPMpZbA3gAKgReIRTilWhV8obAYA0FtUdtMjWaiaTGxAmZHjeAUkKpb6W0jkc5e9bJPVt0NbSO5gkDM45ftHsA4yewAZde4nvAP5%2b6Cw7uPvmkvdrKf/GAGBdI4lxVDQYO0NwbFjr2DECYRIVY7V/AMFywXWwJBApRi2UAMIHgEPUayv2Btsd8Rc9Qs16fCu%2b7lapQRPR8zvKZYfw8DB5xG%2bj8Jmieb8fAI7L7wGJDM9Wcv0S5dixdZPcACBYb6JYn4/lgz1GtM4gdPYYTlrfSWIbDl1izpdv05DFq6jHpJkipK0LeEkujyJpc1B8Mif3nwUAdDjpnn%2b%2bwqTVaCLTZzRRzHKXPsLYRDG31qrlAktBwWQmmi1PUYcTd2lDQAgtPu0j6C9YG2Y8aTh7bcXfCQDYIYY3FzvFqkiKcIUiKpIeJEgbzihL8EmlkfJKonqAVyi9vnLv1QfgeHwBqi577V4/yWwR/YRGlpi/iKS/WO9wlrAI5BNiG%2b2aJVKgR0hVhNAisyvS0uL%2bVmb8DQHQGQDdHP8NAIx9PbTLol6AdY0kCbtA%2bAwpsLEhAYvAVhgaLJAvgDFaE6r3aAGKL%2bgMgG4BoFQSADCrTbvI7wl4B6QNAGYcBU84N%2bMLFOgBQDssyuZG/QDXLVRSttWimIpq03bVNfqfACCe9MUXb4uKUP6SpZMAkLuAzoM3sWfWRfbnfs16CeiJAEDHF8IgEiNRO/C3fNEKdb92igAZVSDUFlFTQK3B%2bArOewAAX701/o%2bMUHWI6A2/%2bsaUu1AR85OkTAyAiZOXOObscdqcHbq5Q8QAISUAeo6UnaMgSeqb4mJPEMsCBAg1gLqfWwBA2x0sxfP9AwDlwSARXeacvKJzhhnHyVWcDfQWz960sbnK8lIrWBzfE07QJq2J0pYdjuABxoq4/ucTGecdBQA6LwFd6zVKWoCRGRqbIiL03RB9wMISBACl5ebKOwbA%2bGq90UaPqhHCKafHsct8H0VM2nkk6stRExIKli6LrpOXNtCbf6awzGW5qWk2cGLRbL7PtEG/PdCcD4YIS9gfyAodtwBQvJwulgAswPgilfWeoPiuwGHS2nxrsYD3DID4hrn6Co3z1fshg5aue1C%2bVt1nGezsotUu9U2lt1aVpT7L7%2brJ7mEicalYLZpZXrA2YMpjprJPmfuHaBWqxssyOVvKVz/qnBDpIv83OkWM7xoaALR99wBYK4w0WXSIRJBp46Oo0FnHLwcOWLjqccu%2bg4Mrflo/WnWdhik9f1d6m3/wfPBR6nG08WKm8ccPsuX00boN9dNGLnzIph9t/tYoKr3YLIEVbL5seXLEO7aARLOc9H08c%2bC5CeXvyN/2/fWwzaAR17Plyeej/oiDrvS6qPR0SvpQ1Q9Yyls9Hf5v9TTWBK1AsQStbOUYjvOx4iIZM%2bnCCoy2VzwfYOUxXSgnCqp%2bspvsHQOAusAO1RHGsx%2b%2b9Or9hz8sXnOD43yAY73PInMXLqqrp04HKX2Mp9OXV/qm%2blchKrOMU4%2bifaie0SuVl09wNnIBk1aohC7iPJ4YMX%2bndJbrzsgHJuC7RW8BgEQzHmJuezPxbMexqccs93scMf3Q2We9Zy66U/Jjpyt8T3/1EPZoNf69Sp/K6f1rFQ7qIeU1WHqxrFFOwzoR0sXjODPax4klgaYHlL66DUWarGuL9upiU/UtAmA0QanvE8S4PIx8NNrV%2b0rDbt%2beL1O1eiCao7GHoBS/wbJWjb%2bG0sfhdZ4tnpulDcsM9Tja6ywvGMhYzUY8js4CiK2tSfuwii78w7djZJu9YI4cNdIBgFUOIJ4eIxybUtpDbp7Grr71PGL%2bGb%2bXE3YcfNF3jnNg9Vbt/G0zZrqmzDxM/ZmOP9V426jxv/Ej9fEU5jws1Vh%2bUCb1LJFF2PDysLWN1ewymkSWiHZ6owxWxvG1AEAsR0osvgscTrqz78MXw9e63fq0XaeL%2bUuUup0lR854O0upLZBlnxpfNTXejG/7Ufu26onM3Vims2xnuSTAwEMZky8R%2bQzfD6sgbMqGy933JMvcLJ8s0%2bmcAEDfGUa6seVltLq6Po2L/%2bPSnYjJ3kdffr9oVWjbISPDKjdq/jJztuxBasYxCfDyXiqsdVPjs9Xew08uFjy%2b/hdlEYGJnKONTbzx9we00o7ySTTIBdLjA5ASczibf%2bZ6ZL95zoFOTVvedciS5b5ybNYzvlfdv44az3v/ya7%2b%2bsvnLIPUX3rA%2bgtIZA1Ikyt%2bEqd9PSpCm74lUlt53CQA8LpDPfzjaJ%2bJHRvP/srrgaZf952MHLhkbXiH4WOjPm3fJa60U3XTBzlywJoiWW6rP7aCP8g0RN23ohrHf8Wf2CmnHmO/Qf1lmGAVQqM0W7tIrVyVUGaHYdqI%2bSZREltxXG9//I6%2b7laQjpLYiHXupraDfwovV6N2cAZbuxDl1KB4qHK%2buG4/dZ//yj%2b1Y6/CTRWWFuoPJWHQ1wSHQLMFvkKDYmql2vhKjqnkF93jG3TpaXJq1JxKOFYW/cH28iHoseoPqbio55%2b3VNctrO7zP/FTlKWjYmBYGv%2boP3oQJP6GEFuFrUPmKNtM9pHqbwoFqc//UcfPVucX/V/9U1t2an3mU2aLv2/xM8tmlvMsj9lZBotX%2bftm9XlrdXw%2bdf47M/f/A2BP3F9XERAjAAAAAElFTkSuQmCC' /%3e%3c/svg%3e) Company / Sole trader

Company / Sole trader

Corporation Tax, Tax on Dividends, Class 1 NI, Employers NI, Class 2 and 4 NI (For Sole traders), Salary vs Dividends

Tax year 2014/2015 (From 6th April 2014 to 5th April 2015)

Tax year 2013/2014 (From 6th April 2013 to 5th April 2014)

Tax year 2012/2013 (From 6th April 2012 to 5th April 2013)

Questions and Advice

Please note I am unable to answer any questions about tax nor am I able to offer advice. For those things, please consult an accountant.

Thank you for your understanding.